Accounting, Where Does 401k Contribution Go On Pension Worksheet

Select Section 1 - Identification Data. Defined contribution plan Company contributes to a scheme eg.

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

Projected Benefit Obligation Pbo Definition

A pension plan is a type of deferred compensation that provides benefit payments to participants after their retirement.

Accounting, where does 401k contribution go on pension worksheet. Defined contributions You set aside a specific amount every paycheck or every month and the financial markets in their unpredictable natures return what they will to you in retirement. But the amount depends on how much you contribute and how. To be classified as a pension plan the future benefit payments must be paid for life or be payable for life at the option of the employee.

In a defined contribution pension plan the contributions are known and are recognized as an expense in the period in which they are incurred. Defined Contribution and Defined Benefit Retirement accounts generally fall into two groups. A pension provides a fixed monthly benefit upon retirement for the rest of your life.

Go to IncomeDeductions Keogh SEP and SIMPLE plans. Now we know that we can do deduction and contribution 18500 25 of compensation maximum of 58000 approx prior to the tax deadline. Two types of pension schemes.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Discover learning games guided lessons and other interactive activities for children. Be sure to select the appropriate schedule in the drop list for the SEP amount to be included in the relevant QBI calculation worksheet s.

On December 31 2011 shall cease participating in the Pension Plan and will become a participant in the Plan. If you are a partner contributions for yourself are shown on the Schedule K-1 Form 1065 you get from the partnership But then the instructions for Form 1065 says this for Schedule K Line 13d. Pension accounting and one must be careful not to mix the two topics.

To input SOLO 401 k. Funds are used from the pension trust to pay the employee in the future and sometimes employees can also make contributions to the trust. Assume that the ABO at 123100 is 300000.

Typical private sector retirement pension plans Defined Contribution Plan. To generate the Self-Employed Pensions SEP Worksheet Wks SEP in the ViewPrint mode of a 1040 return enter the plan contribution rate on the SEP screen. Because the accrued pension cost 46941 is less than the.

Sole proprietors and partners deduct contributions for themselves on line 28 of Form 1040. Pension plans can also provide disability death and survivor benefits. Both are calculated using similar principles.

Write 401k Expense in the accounts column of the journal entry and the amount you will contribute toward your employees 401k plans in the debit column on the first line of the entry. So we have a husbandwife partnership passthrough LLC we are taking w2 from this LLC We open a 401k Solo account in Dec 2018 so to establish 401k in 2018. Pension contributions payable are expensed to PL.

Effective January 1 2012. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. In Line 12 - Total amount of SIMPLE plan contributions input the predetermined amount.

Accounting for a Defined Contribution Pension Plan. THE BASICS The cash contribution and pension expense calculations are both often referred to as the cost of a pension plan one as a cash outlay and the other as a reduction or increase in company earnings. B provide that.

401ks and IRAs provide income in retirement too. Then the unfunded portion of the ABO is 300000-250000 50000. Employers make contributions to the pension trust.

If the business matches the timing and amount of their contributions to the obligations for each accounting period it is not necessary for it to recognize any further liabilities. Debit means an increase for expense accounts. Discover learning games guided lessons and other interactive activities for children.

The ending pension liability on the balance sheet needs to be at least equal to the unfunded Accumulated Benefit Obligation the PBO without any adjustment for future salaries. For example write 401k Expense in the accounts column and 500 in the debit column. Employees provide services to the employer and in return they receive wages.

These are 401k and 403b accounts IRAs and similar risk. IRAs 401k Defined benefit plan Company pays out benefits on retirement eg. During the year ended December 31 2011 the Plan was amended to a provide that any hourly organized employee at the Everett facility who participated in the Pension Plan as of 1159 pm.

In Line 1 - TS input the appropriate code for taxpayer T or spouse S.

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

Projected Benefit Obligation Pbo Definition

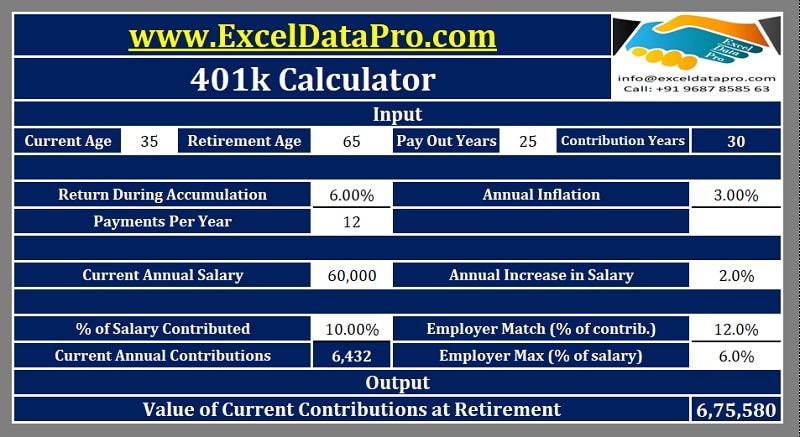

Download 401k Calculator Excel Template Exceldatapro

:max_bytes(150000):strip_icc()/Ford_Pension-266748d9d69f40208878c0917b463882.png)

Projected Benefit Obligation Pbo Definition

401k Contribution Calculator Step By Step Guide With Examples

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use O Retirement Planning Calculator How To Plan Finance Blog

Investing Beyond Your 401 K How To Do It And Why You Should Investing Roth Ira Investing For Retirement

Pin On Excel Retirement Calculator

Retirement Savings Start With Your 401k 401k Saving For Retirement Investment Tips