How Are Office Supplies Recorded On A Worksheet Accounting

Are grouped by purposeOffice Supplies Store Supplies Office Supplies includes stationery paper toner pens. The person managing the inventory also monitors the current supplies and the number of items needs to be ordered.

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Bookkeeping Business Small Business Bookkeeping

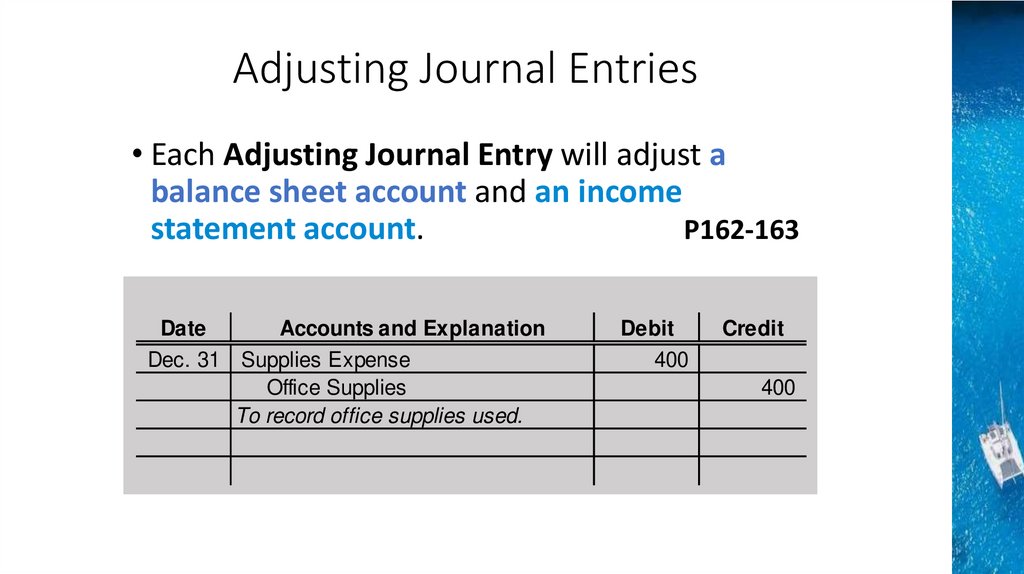

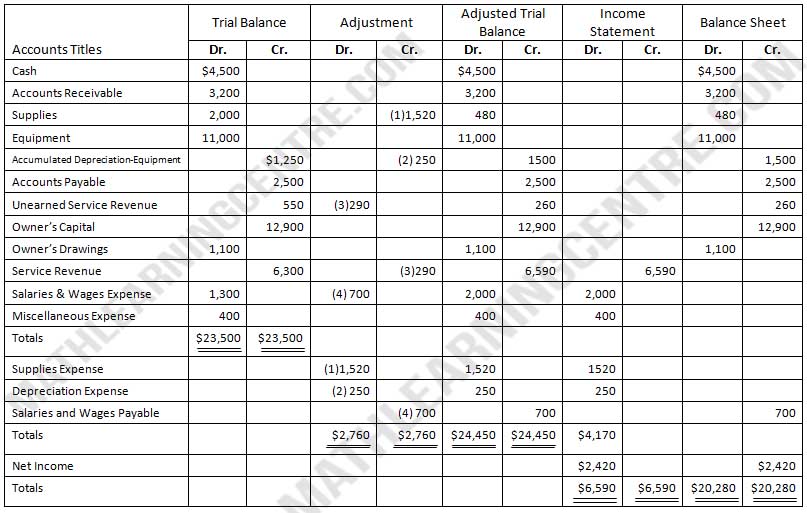

This supplies expense would be recorded with the following journal.

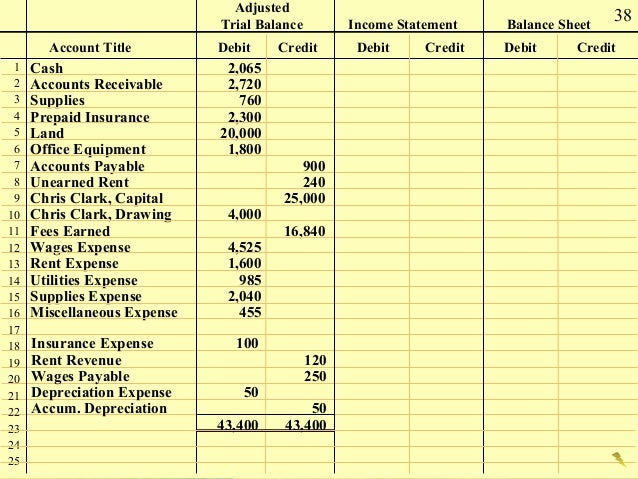

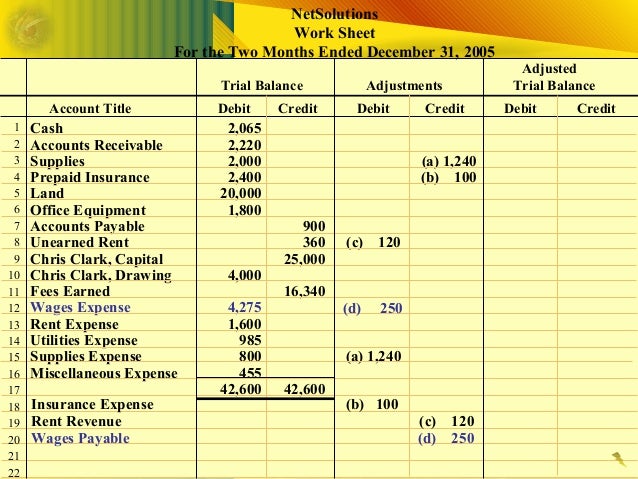

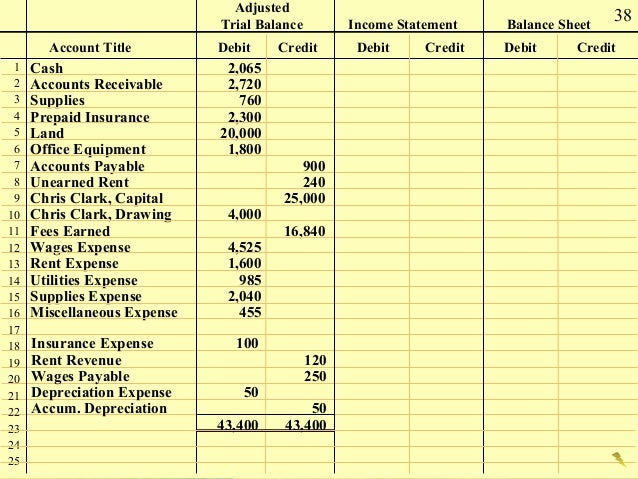

How are office supplies recorded on a worksheet accounting. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. On January 1 of the current year Yacapin purchased office equipment costing P150 000 with an expected value of five 5 years and no salvage value. The cost of the office supplies used up during the accounting period should be recorded in the income statement account Supplies Expense.

Office Supply Inventory Spreadsheet Excel and Sample Office Supplies Inventory Checklist. Source documents are used by the accounting department as the primary source of. We tried to get some great references about Office Supply Inventory Spreadsheet Excel and Sample Office Supplies Inventory Checklist for you.

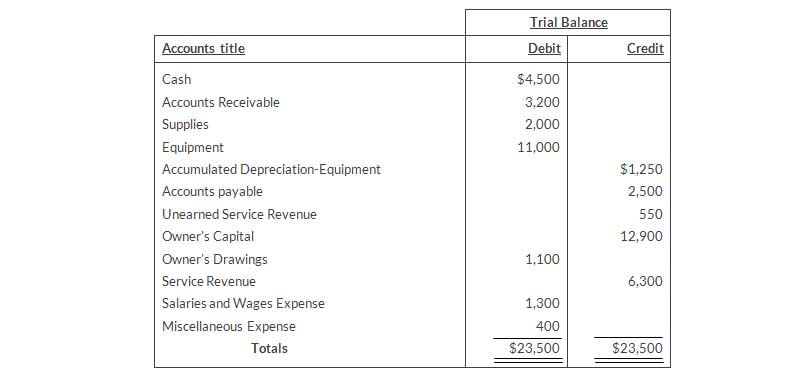

Supplies on hand adjusting entry. At the end of the accounting period the balance in the account Supplies will be adjusted to be the amount on hand and the amount of the adjustment will be recorded in Supplies Expense. The Current Assets are Cash Account Receivable and Office Supplies.

We hope you can find what you need here. A device that scans printed information translating it into electronic impulses over telephone lines which when received is translated back into. If the cost is significant small businesses can record the amount of unused supplies on their balance sheet in the asset account under Supplies.

When used up their costs are reported as expenses. Supplies Are considered assets until they are used. Thus consuming supplies converts the supplies asset into an expense.

This account shows a balance of 2500 in the October 31 trial balance. Building is not included. It was coming from reputable online resource which we like it.

The inventory manager needs to track and prioritize the items in the inventory to prevent a shortage or to avoid disrupting the business. Supplies can be considered a current asset if their dollar value is significant. Your office expenses can be separated into two groups - office supplies and office expenses.

Supplies expense Beginning supplies on hand Purchases - Ending supplies on hand Supplies expense 1200 400 - 900 Supplies expense 700. Yazici recorded the purchase by increasing debiting the asset Supplies. The business would then record the supplies used during the accounting period on the income statement as Supplies Expense.

The accounting department learns about all the transactions in a business through the source documents that are sent to the accounting of ce. In every office it is crucial to handle the supply inventory efficiently and accurately. Discover learning games guided lessons and other interactive activities for children.

Office supplies on hand at year-end amounted to P3 000. Worth of Prepaid Insurance an asset and is recorded as an expense. A source document is a business paper that provides all the details about a business transaction.

The current ratio is calculated by dividing total Current Assets by total Current Liabilities. Discover learning games guided lessons and other interactive activities for children. Its important to correctly classify your office expenses supplies and equipment to make things easier for tax time.

An inventory count at the close of business on October 31 reveals that 1000 of supplies are still on hand. The Current Liabilities are Accounts Payable and Salaries Payable. The third large office equipment or furniture should each be classified as a fixed asset to be depreciated over time.

Despite the temptation to record supplies as an asset it is generally much easier to record supplies as an expense as soon as they are purchased in order to avoid tracking the amount and cost of supplies on hand. Instructions a computer needs to function. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

For example a company that just purchased its office supplies from Company B and received an invoice of 500 should record the amount in its accounts payable sub-ledger and pay it on or before the due date to improve its cash flow and avoid late penalty fees. The current ratio is 600 500 100 300 200 240. When supplies are purchased the amount will be debited to Supplies.

Computer equipment costing P60 000 with an expected life of three 3 years and no salvage value was purchased on July 1 of the.

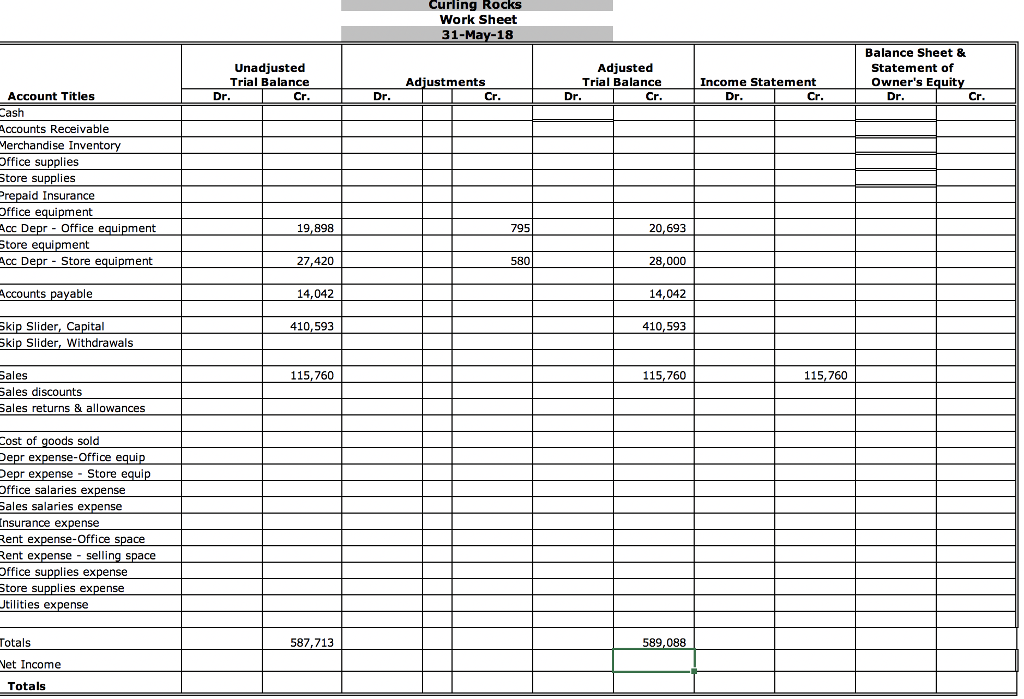

Problem 1 Completing The Accounting Cycle

Ch04 Completing The Accounting Cycle Intro Accounting 21st Editio

Accounting Worksheet Assignment

Prices And Amounts Of Office Supplies Can Be Tracked And Amended In This Corporate Inve Office Supplies Checklist Craft Supplies Inventory Spreadsheet Business

Recording Business Transactions Accounting Prezentaciya Onlajn

Problem 1 Completing The Accounting Cycle

Century 21 Accounting C 2009 South Western Cengage Learning Lesson 8 1 Recording Adjusting Entries Accounting Pe Lesson Plan Examples Lesson Accounting Period

Solved Please Finish Preparing The Worksheet All Include Chegg Com

Ch04 Completing The Accounting Cycle Intro Accounting 21st Editio