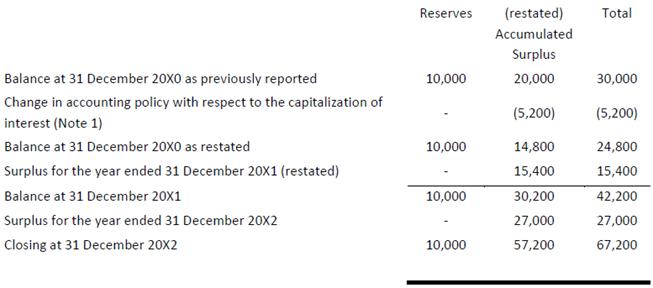

Surplus Accounting Valuation Worksheet

Reproduced with permission of the copyright owner. The Revaluation Worksheet allows you to revalue financial assets in accordance with International Accounting Standards IAS 16 to reflect current fair value provided that the net book value NBV of an asset is less than its fair value FV at a given point.

The BCVR is similar to the Asset Revaluation Surplus ARS account Worksheet from ACCT 201 at University of Wollongong Dubai.

Surplus accounting valuation worksheet. This spreadsheet allows you to measure the complexity in a company and give it a score. Gratuity Valuation - PL and Balance Sheet Accounting Modified on. This spreadsheet allows you to value employee options and incorporate them into value.

Depreciation expense during next year year 3 would be based on the new carrying value ie. Valuation and clean surplus accounting for operating and fin Contemporary Accounting Research. Discover learning games guided lessons and other interactive activities for children.

Under revaluation model non-current assets may be carried at revalued amount ie. Market value is assumed to equal the net present value of expected future dividends and is shown under clean surplus accounting to also equal book value. 39 Business Valuation Template.

What is Valuation Modeling in Excel. Surplus Assets in Business Valuations. Business Assets and Liabilities.

Discover learning games guided lessons and other interactive activities for children. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow DCF method by using the weighted average cost of capital WACC as a discount rate for future cash flow projections over three and five year periods. Valuation and Clean Surplus Accounting for Operating and Financial Activities Rizki Andriani Valuation and clean surplus accounting for operating and fin Contemporary Accounting Research.

689 Reproduced with permission of the copyright owner. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. The model is simply a forecast of a companys unlevered free cash flow analysis comparable trading multiples precedent transactions.

Since PVED and the clean surplus relation imply that the market value equals the book value plus the present value of future expected abnormal eamings see Peetsnell 1981 the valuation analysis can focus on the prediction of. As part of the process of valuing a company we revalue the balance sheet of a company from book value to market value and then separate the assets and liabilities of the company into three categories. Book value equals market value for financial activities but they can differ for operating activities.

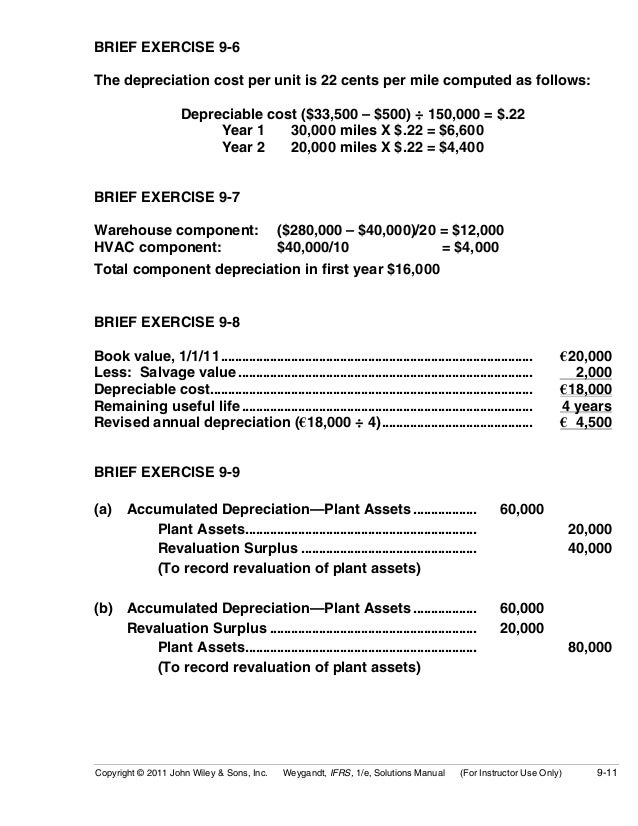

Further reproduction prohibited without permission. Under the revaluation model management needs to record a surplus of 25000. This topic lists the page used to revalue assets using the Revaluation Worksheet.

Surplus Assets Liabilities. At the time of acquisition non-current assets are recorded at cost. Valuation is the process of calculating the current worth of an asset or liability.

The journal entry would be. In that situation the following journal entry would have been required. Common terms used when discussing the value of an asset or liability are market value fair value and intrinsic value.

664 Contemporary Accounting Research value that is eamings minus a charge for the use of capital. Market value is assumed to equal the net present value of expected future dividends and is shown under clean surplus accounting to also equal book value plus the net present value of expected future abnormal earnings which equals accounting earnings minus an interest charge on opening book value. Valuation modeling in Excel may refer to several different types of analysis including discounted cash flow DCF DCF Model Training Free Guide A DCF model is a specific type of financial model used to value a business.

In contrast the accounting for operating assets receivables inventory etc precipitates m ore intricat e concem s because these assets are typically not individual-ly traded in perfect m arkets. This spreadsheet allows you to understand why the gross and net debt approaches give you different estimates of value for a firm. Fair value of asset at the date of revaluation less subsequent accumulated depreciation and.

Accounting for financial activities can be view ed as either redundant or straightforw ard eg the accounting for interes t accm als. Depreciation for 3rd year would be 85000 3 28333. Examples of assets are stocks options companies or intangible assets.

After initial recognition however entities can either continue to measure asset on historical-cost basis or change it to revaluation basis. Concerning liabilities they can be bonds issued by a company. This paper models the relation between a firms market value and accounting data concerning operating and financial activities.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Reproduced with permission of the copyright owner. The term gratuity comes from the word gratitude - in the context it is meant as a thank you expressed by the company to its employees.

Gratuity is an employee benefit scheme which is classified as a Defined Benefits Obligation DBO Plan. 85000 and remaining useful life of 3 years. Further reproduction prohibited without permission.

Sun 21 Jun 2020 at 729 PM. Carrying value of asset at the end of year 2 would be as follows. Had the fair value been 140000 the excess of carrying amount over fair value would have been 27648.

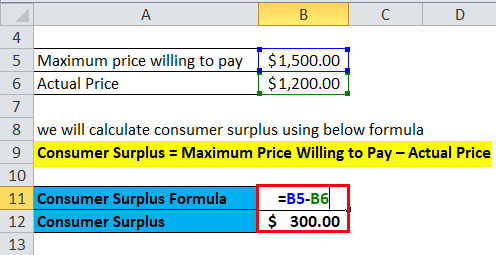

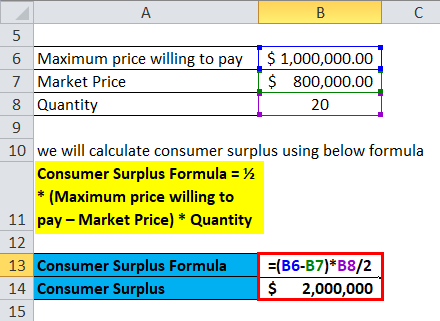

Consumer Surplus Formula Calculator Excel Template

Pin On Rbse Solutions For Class 12 Accountancy

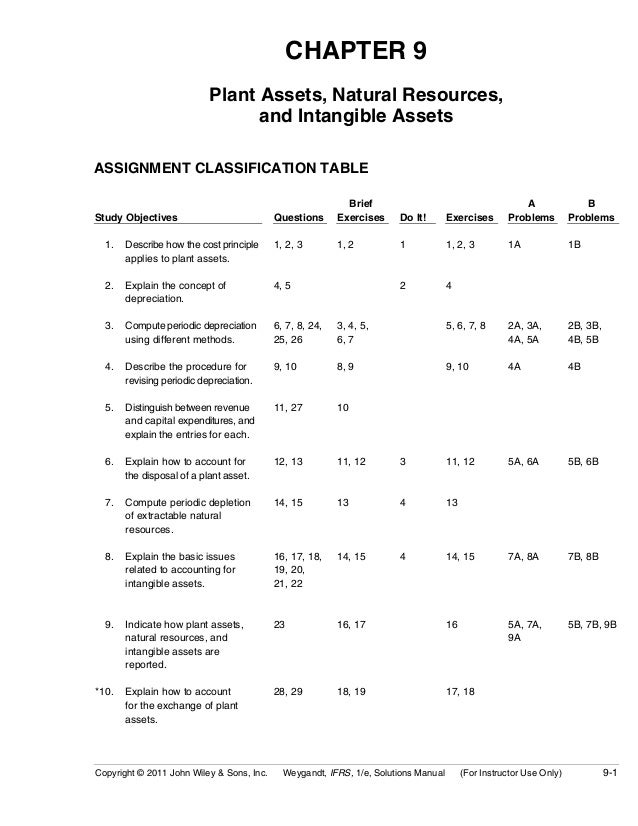

Ch09 Solution W Kieso Ifrs 1st Edi

Cambridge Igcse Accounting 0452 International Accounting Standards Ias Guidance For Teachers

Pin Di Tips Cara Pintar Dalam Kehidupan Sehari Hari Anda

Financial Statements Personal Accounting Checklist Chapter 1 Meaning

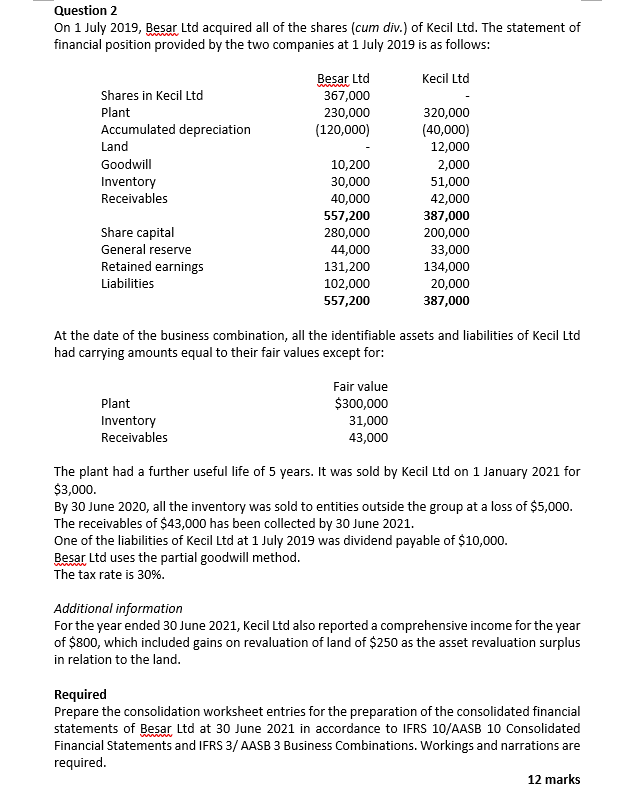

Question 2 On 1 July 2019 Besar Ltd Acquired All Of Chegg Com

Doc Performing An Analysis Of Surplus Dr Maurice O Connell Academia Edu

Ch09 Solution W Kieso Ifrs 1st Edi