Where Do I Find Taxable Income On Accounting Worksheet

The recognition of a deferred tax liability or. The recognition of a tax liability or tax asset based on the estimated amount of income taxes payable or refundable for the current year.

Ch04 Kieso Intermediate Accounting Solution Manual

Again you explain the timing of both gross income and the allowable deductions.

Where do i find taxable income on accounting worksheet. In other words an accounting worksheet is basically a spreadsheet that shows all of the major steps in the accounting cycle side by side. The accounting worksheet is essentially a spreadsheet that tracks each step of the accounting cycle. Is the W-2 showing it as taxable.

Discover learning games guided lessons and other interactive activities for children. The non-taxable portion of income will be grossed up by 25 which will then be. Select Forms in the upper right hand corner of your open return.

Use the Publication 535 worksheet if your taxable income before the QBI deduction is higher than that threshold. Go to Income Consolidated 1099. You can see the worksheet in Forms mode.

Taxable Interest x x x Tax Exempt Interest x x US. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Line 20 State enter another state or XX.

Simply put a company is taxed on the profit it makes after all allowable deductions are subtracted from its revenues. Taxable income is defined by Internal Revenue Code IRC section 63 on gross income less allowable deductions. Line 21 - Additional amount enter the portion that is taxable to the state from line 16.

How can I see the completed worksheet for taxable Social Security Income. Distributable Net Income and Taxable Income Trust Accounting Income Distributable Net Income Taxable Income Income. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Dependent has 1098-T with taxable scholarship income. Jaimes new average tax rate is 6306300 or 10 equal to his marginal rate because all of his taxable income is in the lowest tax bracket. To gross up the non-taxable portion of income see section 13.

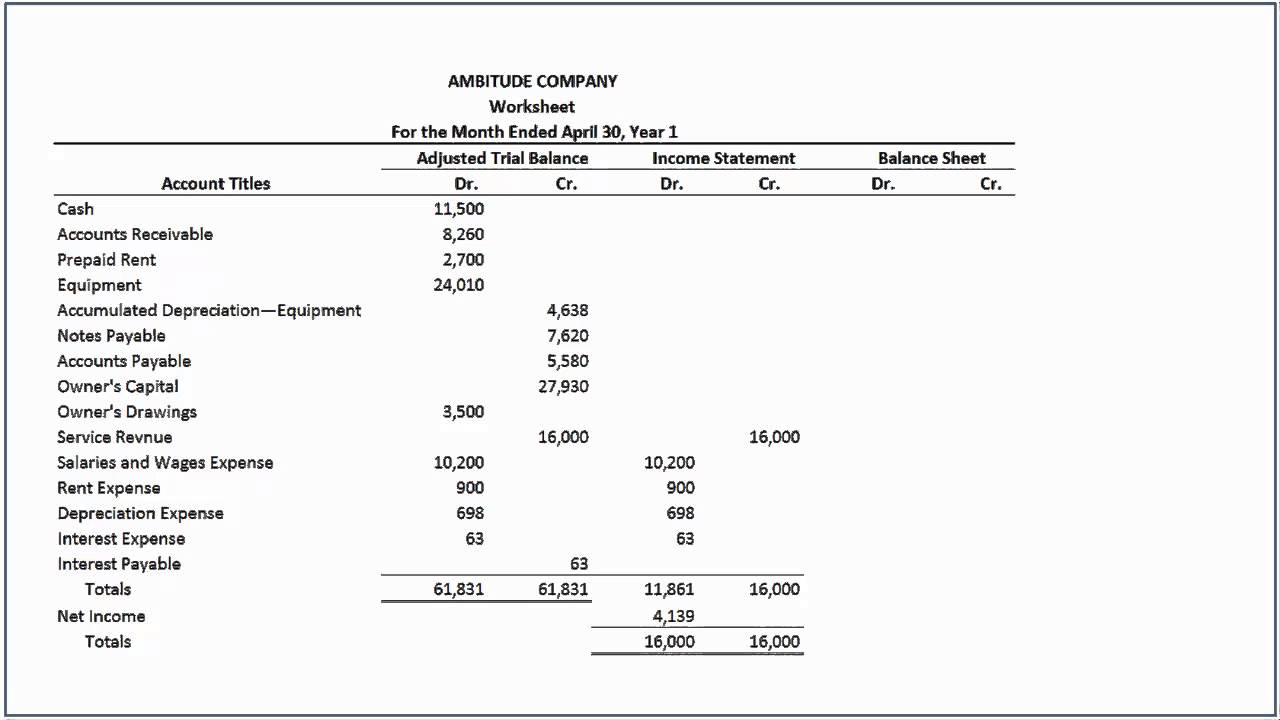

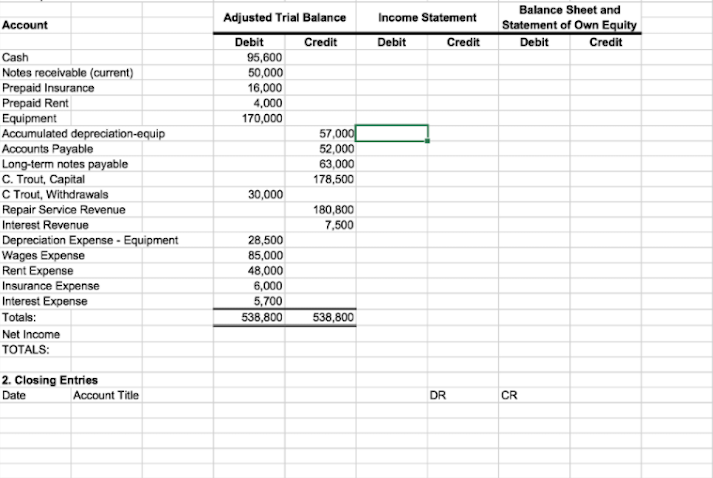

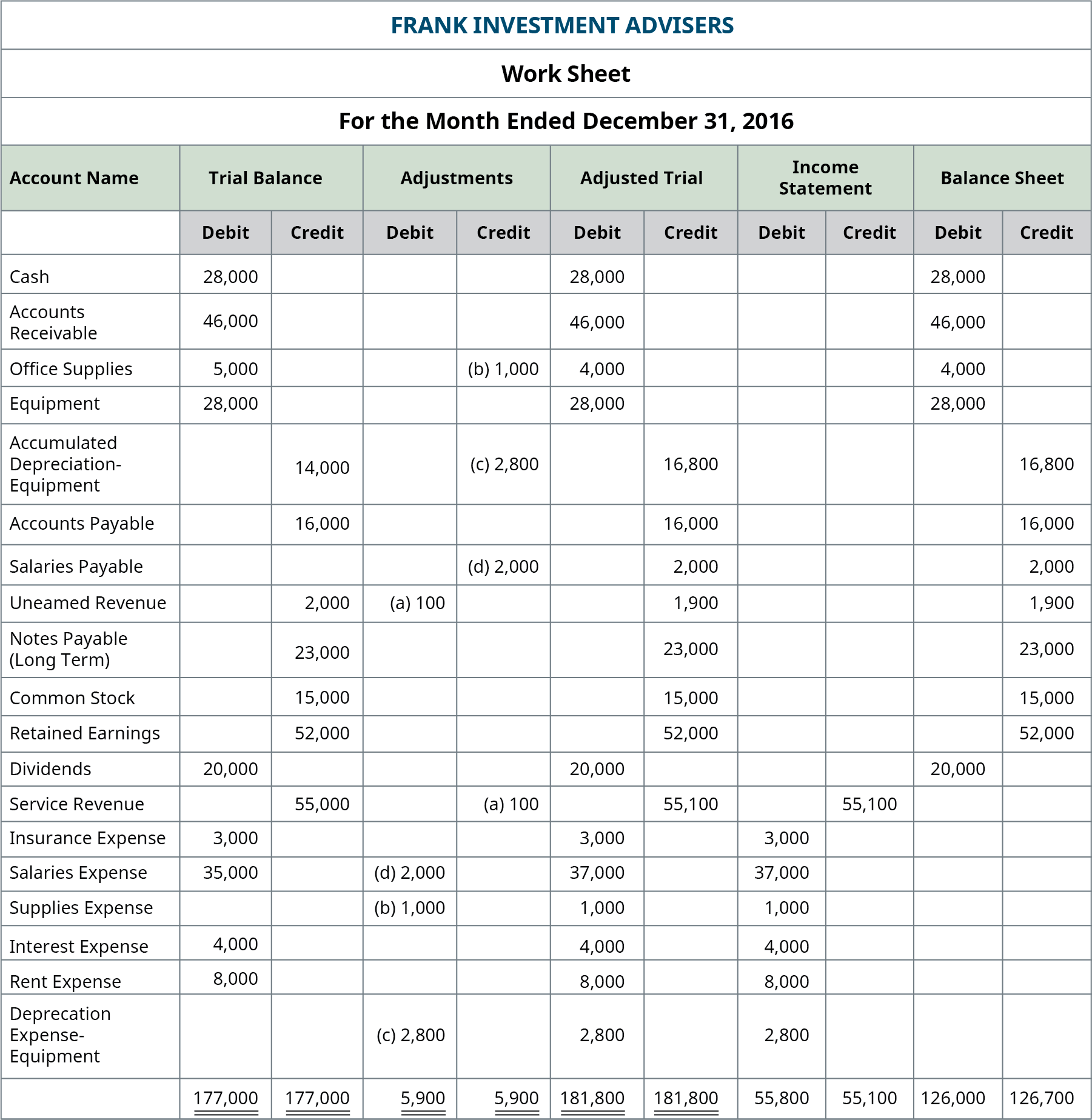

Some benefits of the Excel worksheet include the ability to enter adjusting entries in an efficient way and build an adjusted trial balance the ability to enter tax entries efficiently and build a trial balance on a tax basis and the ability to reconcile book net income and tax net income. Next they find the column for married filing jointly and read down the column. Dont forget that the IRS lets you choose if you want that income to qualify as Earned Income or not for purposes of the Earned Income Credit.

Discover learning games guided lessons and other interactive activities for children. Non-taxable Income To be grossed up Definition. The amount shown where the taxable income line and filing status column meet is 2644.

Use the worksheet in the Form 1040 instructions if your taxable income before the QBI deduction isnt more than 157500 315000 if married filing jointly. Essential Accounting for Income Taxes. You can think of it like a formula.

Ive entered the 1098-T and also completed the Student Information Worksheet. Revenues is any income your business earns. When tax exempt interest is partially taxable to the state do the following.

What is taxable income. If line 15 taxable income is. This is the tax amount they should enter in the entry space on Form 1040 line 16.

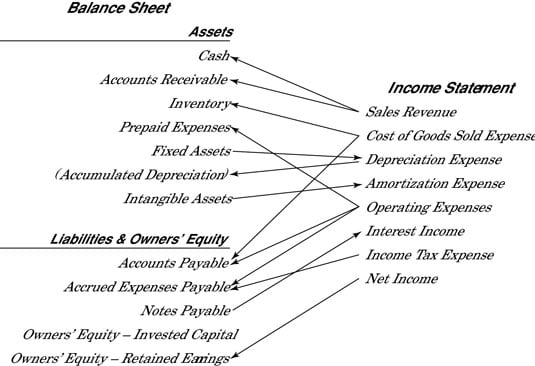

Despite the complexity inherent in income taxes the essential accounting in this area is derived from the need to recognize two items which are. Taxable Income Formula Gross Total Income Total Exemptions Total Deductions On the other hand the calculation of the taxable income of a corporation is done by deducting the cost of goods sold operating expenses and interest paid on debts from the gross sales of the company. Government Interest x x x Dividends x x x Partnership Income x x x Passive Loss Limitation x x Other Estate or Trust Income x x x Rental Income x x x Royalty Income x x x Schedule C Business Income x x x Capital Gain Loss x.

The taxable portion appears correctly on the worksheet but does not show up on Form 1040 Line 1. First they find the 2530025350 taxable income line. Taxable income equals assessable income minus deductions.

Section 2 Dividend Income. 6300 x 10 630 owed in taxes. Subtotal Total Step 1 Enter the monthly amount of social security income received as supported on the social security award letter Section 13.

Line 16 - Tax-exempt interest enter the amount that is exempt for the state. If so then back it out as a negative number on other income on Schedule 1. The spreadsheet typically has five sets of columns that start with the unadjusted trial balance accounts and end with the financial statements.

So it shows all of the significant steps of the accounting cycle of the company side by side. All the accounts of the accounting records of the company are shown in the accounting worksheet in at-least one of the columns which is an essential step for preventing the errors when the companys final financial statements are prepared. I cant find anywhere else to.

An Excel worksheet can be used to show the difference between net income on the unadjusted trial balance the adjusted trial. Section 1 General. Line 1 State - enter the state code.

Revenues Deductions Taxable Income. If you are carrying on a business to work out your taxable income use your business operating profit or loss as a starting point. If Tameka earns 50000 from her job as an accountant how much federal income tax.

Jaimes marginal tax rate is now 10 for all of his taxable income. In general any revenue is taxable unless IRS rules specifically exclude it. The formula to work out your taxable income is.

How To Complete The Worksheet Accounting Principles Youtube

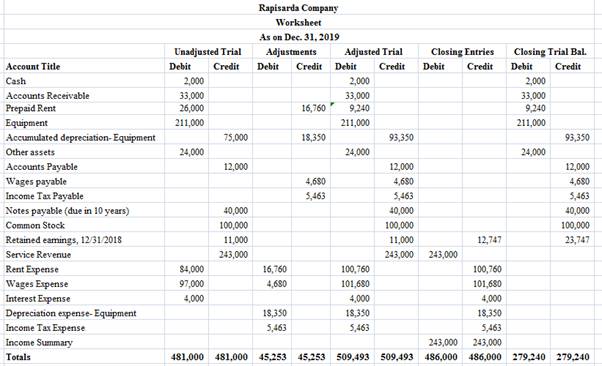

Exercise 3 61 Preparation Of A Worksheet Appendix 3a Unadjusted Account Balances At December 31 2019 For Rapisarda Company Are As Follows The Following Data Are Not Yet Recorded Depreciation On The Equipment

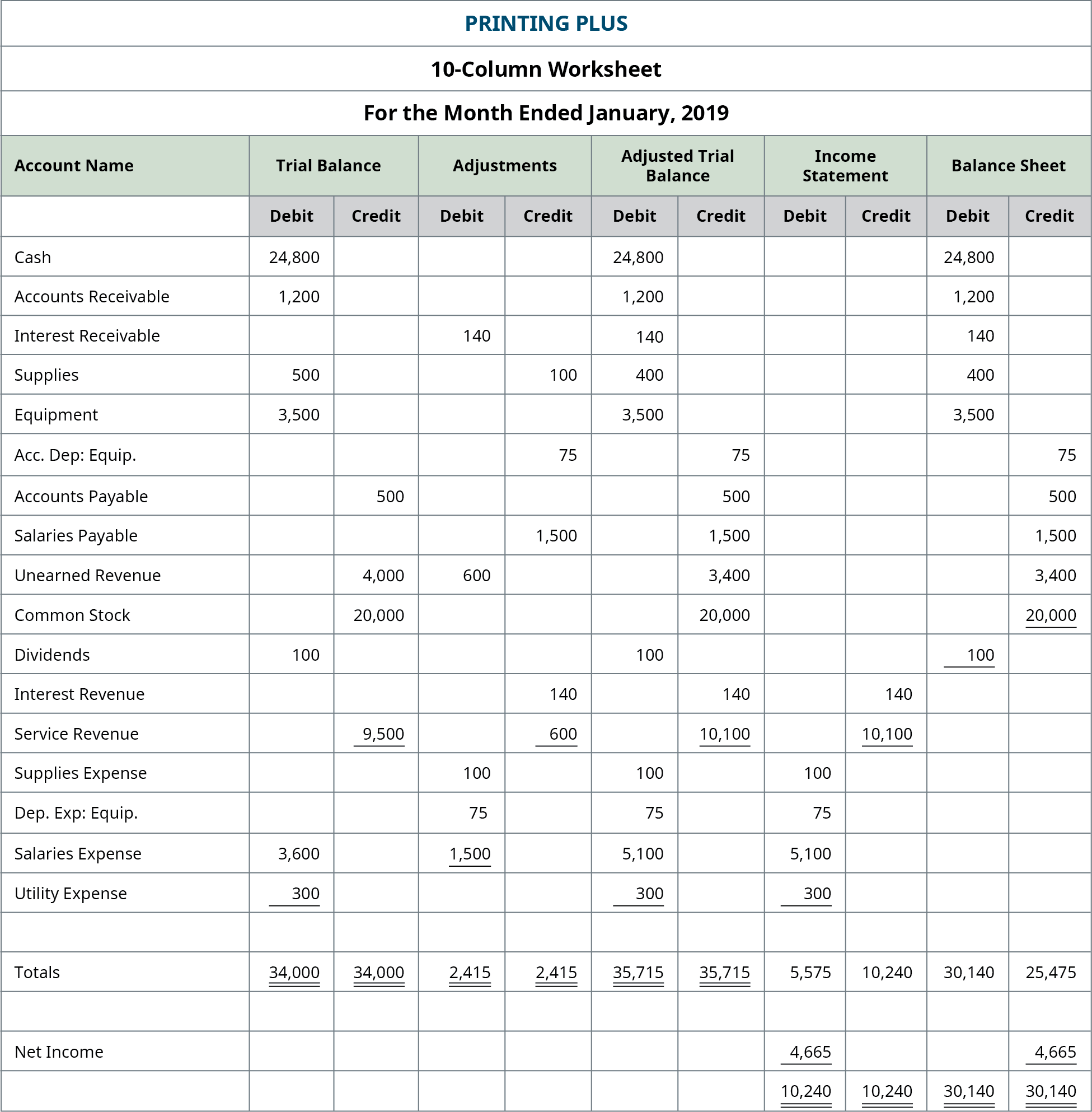

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

A Beginner S Guide To The Post Closing Trial Balance The Blueprint

Accounting Worksheet Definition Example Of Spreadsheet For Letter Preschool Worksheets Free Tracing 1st Grade Measurement Budget Excel Simple Monthly Sheet Place Value Practice Calamityjanetheshow

Online Account Reading What Is Accounting Worksheet Types Of Accounting Worksheet 10 Sheet Column

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting